How NYC Factoring Companies Can Help Your Business

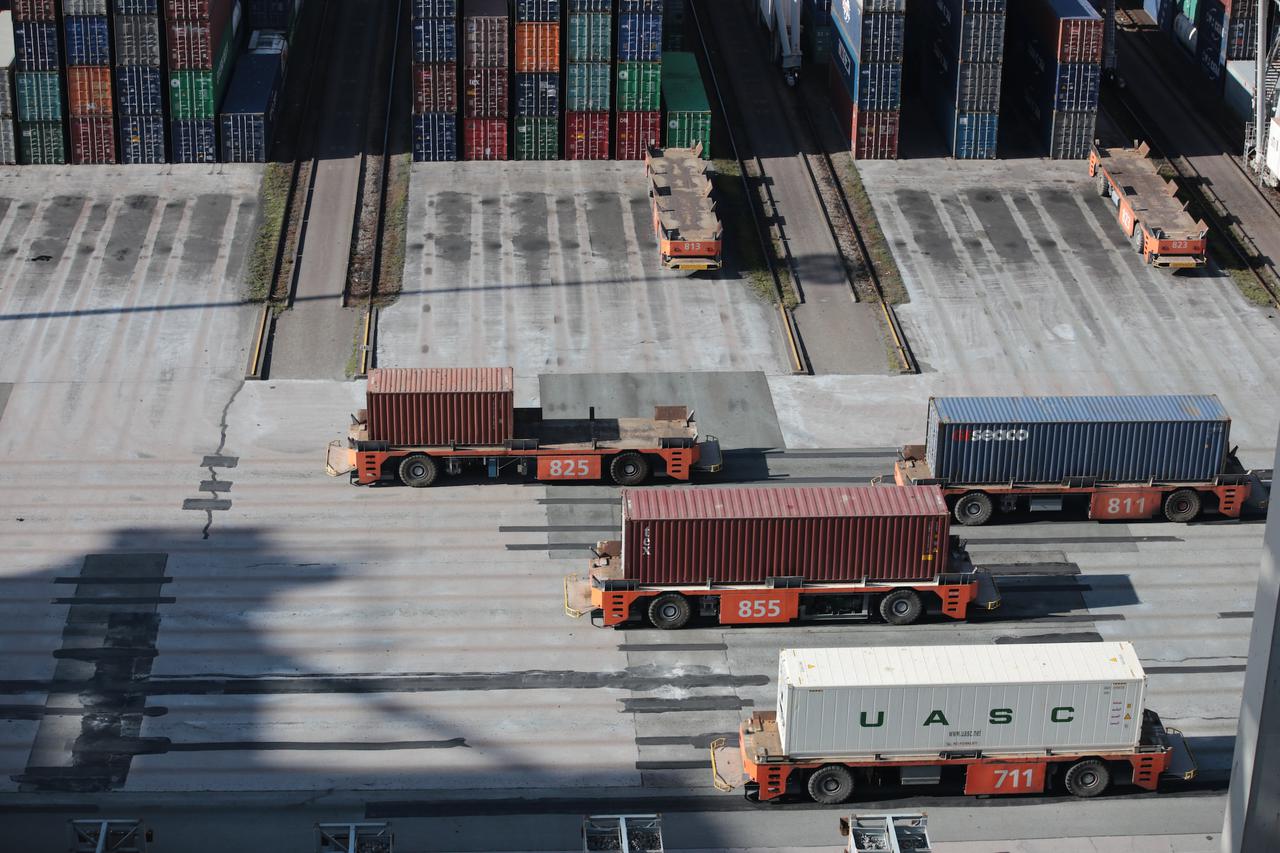

As a business owner, managing cash flow is one of the most critical aspects of running a successful operation. However, it can also be a time-consuming and stress-inducing part of running your business. For transportation businesses, NYC factoring companies have become an increasingly popular solution to help improve cash flow and streamline operations. If you’re not familiar with how freight factoring works, this guide outlines what you can expect and the many benefits you can enjoy when you partner with a provider.

What is Freight Factoring?

Freight factoring is a financial service that provides cash advances to trucking companies based on their outstanding invoices. Essentially, a NYC freight factoring company purchases the right to collect on a transportation business’ unpaid invoices at a discount. The transportation company then receives a cash advance for the value of those invoices, minus the factoring company’s fee.

This service is particularly useful for transportation companies that have to wait 30, 60, or even 90 days to receive payment from their customers. With freight factoring, these companies can receive payment immediately and use those funds to cover expenses like fuel, maintenance, and payroll.

What to expect when partnering with NYC factoring companies.

The process of freight factoring typically involves the following steps:

- The transportation company delivers goods to their customer and sends an invoice for payment.

- The transportation company submits the invoice to the freight factoring company.

- The factoring company verifies the invoice and advances the transportation company a percentage of the invoice value, usually between 80-90%.

- The freight factoring company collects payment from the transportation company’s customer on the due date.

- The freight factoring company then deducts its fee from the collected payment and returns the remaining balance to the transportation company.

It’s worth noting that not all freight factoring providers operate in the same way. Some companies may require a long-term contract or have different fee structures. It’s essential to research and compare different service providers to find the best fit for your business.

Benefits of working with NYC factoring companies.

Improved cash flow.

By factoring unpaid invoices, transportation companies can receive payment immediately, which can help improve cash flow and provide funds for day-to-day expenses. This makes it easier to manage your daily operations and grow your business.

Reduced administrative burden.

Your providers the collection of invoices, which can save transportation companies time and resources on administrative tasks. That leaves you more time to focus on business-critical tasks.

Access to working capital.

Freight factoring is a quick and easy way for transportation companies to access working capital without having to go through a lengthy loan approval process. When you partner with one, you’ll always have the capital you need to fulfill your orders, regardless of how big they become.

Better credit management.

Since your loan is based on existing invoices, you don’t need to worry about bad credit. Companies can typically factor their freight regardless of their credit score, which allows you to avoid business loans with high-interest rates.

Flexibility.

Freight factoring companies can work with transportation companies of all sizes and can provide funding for both large and small invoices. Many even work on short-term contracts, so you can take advantage of their services only when you need the help.

Are you interested in partnering with a NYC factoring company?

At BP Financing, we make it easier for you to access the cash you’re owed. As one of the premier NYC factoring companies, we focus primarily on accounts receivable financing, which means you’ll see your money within the next 24 hours rather than having to wait weeks or even months. You can learn more about our process online, or get in touch to get started today.